UMB FINANCIAL (UMBF)·Q4 2025 Earnings Summary

UMB Financial Crushes Q4 as Heartland Acquisition Drives Record Year

January 28, 2026 · by Fintool AI Agent

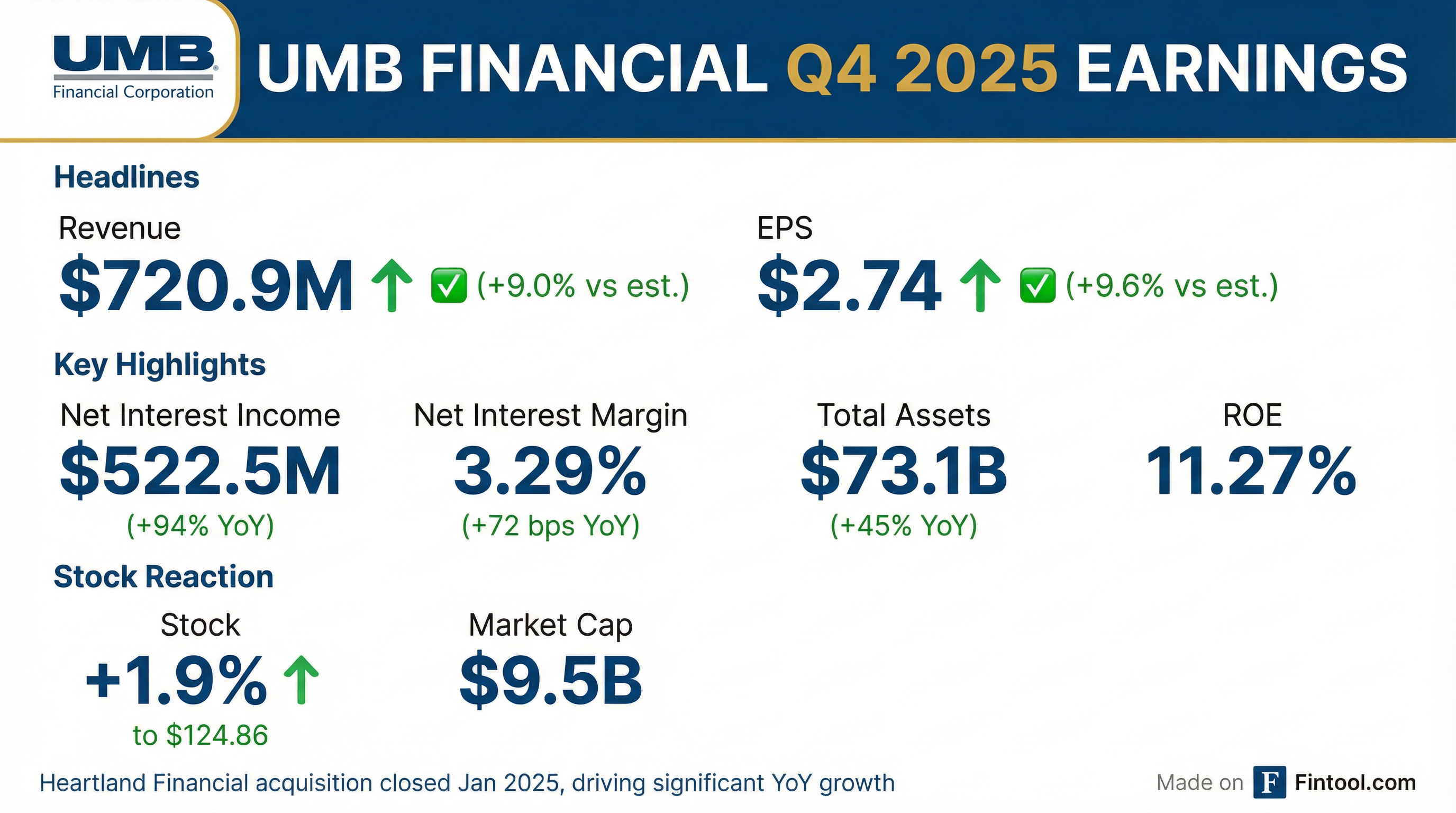

UMB Financial Corporation delivered a strong beat on both top and bottom lines in Q4 2025, with operating EPS of $3.08 (+13.9% vs. consensus) and revenue of $729.6 million (+7.7% vs. consensus). The Kansas City-based regional bank continues to benefit from the transformational Heartland Financial acquisition completed in January 2025, which drove 94% year-over-year growth in net interest income and pushed total assets to $73.1 billion.

On the earnings call, CEO Mariner Kemper called the Heartland integration "flawless" and confirmed 100% of targeted cost synergies have been realized. First quarter outlook is strong, with loan production expected to match Q4 levels.

Shares touched a new 52-week high of $129.95 intraday following the earnings call before settling at $125.04.

Did UMB Financial Beat Earnings?

Yes—double beat with meaningful upside on both metrics.

*Values retrieved from S&P Global

The operating EPS of $3.08 excludes $39.7 million in acquisition-related costs, providing a cleaner view of underlying profitability. Net income available for common shareholders was $209.5 million, up 16.1% from Q3.

Beat streak continues. UMB has now beaten EPS consensus for 8 consecutive quarters, with this quarter's 13.9% operating EPS beat the strongest in recent history.

What Drove the Strong Results?

Net Interest Income Surged 94% YoY

Net interest income of $522.5 million was the headline driver, up 94.3% from Q4 2024 and 10.0% sequentially. Key factors:

The NIM expansion was driven by favorable deposit mix shift (demand deposits increased 24.9% linked-quarter annualized) and repricing benefits following Fed rate cuts.

Heartland Integration on Track

The acquisition of Heartland Financial, which closed January 31, 2025, transformed UMB's scale:

- Total assets: $73.1B (+45% YoY)

- Average earning assets: +50.5% YoY

- Acquisition costs: $39.7M in Q4 (down from $35.6M in Q3)

Credit Quality Remains Excellent

Net charge-offs of just 13 basis points were well below the company's long-term historical averages. Full-year 2025 NCOs were 23 bps.

What Did Management Say?

"We reported another strong quarter to close out 2025 with the successful acquisition of Heartland Financial, the opening of our first branch location in Utah, and another year of record earnings. I'm incredibly proud of our associates for delivering strong fundamental and financial performance in 2025."

— Mariner Kemper, Chairman & CEO

On the Heartland integration:

"The transaction went so well, incredibly well, flawlessly... We had ambassadors from UMB that were tied to locations and individuals across the company who were there for the conversion to be there to answer questions and help them through the customer interactions. It was a fantastic fantastic deal."

— Mariner Kemper

On M&A appetite:

"As I've said many times, we don't need to do M&A. We have a strong, proven ability to generate assets, and we continue to take share and grow organically at a pace ahead of our peers... Organic growth is, and always will be our top capital priority."

— Mariner Kemper

Key metrics highlighted on the call :

- ROAA: 1.20% (vs 1.04% Q3)

- ROACE: 11.27% (vs 10.14% Q3)

- Efficiency ratio: 55.5% (vs 58.1% Q3, 61.8% Q4 2024)

- Loan growth: 13% annualized vs peer median of 4.9%

- Net charge-offs: 13 bps vs industry median of 55 bps NPLs

How Did the Stock React?

The stock touched a new 52-week high of $129.95 during the January 28 session following positive call commentary, before settling at $125.04. UMBF is up 52% over the past 12 months.

What Changed From Last Quarter?

Key sequential changes:

- NII expansion (+10%) driven by deposit mix shift, rate repricing, and loan growth

- Noninterest income dip (-2.4%) due to lower company-owned life insurance income and derivative activity

- Efficiency ratio improvement reflects scale benefits from Heartland integration

Q&A Highlights

Key insights from the analyst Q&A session:

Loan Growth Drivers

Management attributed CNI's 27% annualized growth to broad-based strength across markets and verticals. Specific highlights:

- Energy lending remains strong

- M&A/family office transactional work driving growth

- Franchise lending from Heartland "been additive"

- California ag business is a "real bright spot"

"50% of our growth comes from new customer acquisition, and that 50% largely comes from market share gains."

— Mariner Kemper

Heartland Revenue Synergies

Kemper outlined key revenue opportunities from Heartland :

- Mortgage: Heartland "didn't really have a mortgage product"—UMB's custom mortgage can now be offered across the footprint

- Credit cards: Already launched across acquired customer base

- Corporate trust: Local presence in California, New Mexico, Wisconsin, Minnesota expands reach

- Treasury management: Heartland had "basic platform"—upgrade opportunity

- Legal lending limit: Deals where Heartland was a 25% participant, UMB can now lead or take whole deals

NIM Outlook

CFO Ram Shankar expects core NIM to remain "plus or minus" the Q4 adjusted level of 2.92%. Key factors:

- Internal forecast: Two rate cuts in 2026 (June and Q4)

- SOFR has been a "tailwind" with favorable basis risk

- Bond reinvestment yields of 4.25-4.40% vs roll-off of 3.60%

M&A Stance

Management emphasized organic growth as the top priority:

- Wary of approaching $100B threshold: "We are in the early stages of assessing what the threshold means to us"

- Open to tuck-ins: "Lift outs in our corporate trust and other places... we do little announcements, small, tiny, little acquisitions"

- Culture is paramount: "The number one rule in any of these is going to be culture" — Jim Rine

First Quarter Outlook

- Loan production: Expected "as strong as or near the fourth quarter"

- Operating expenses: $385-390M range, including ~$15M seasonal increase in FICA, payroll taxes, 401k

- Q2 FICA/payroll: Expected to decline by ~$10M

- Effective tax rate: 20-22% for full year 2026

Capital & Dividend Update

UMB announced a quarterly dividend of $0.43 per share, payable April 1, 2026—a 7.5% increase from the $0.40 dividend in Q4 2024.

All regulatory capital ratios exceed "well-capitalized" thresholds.

Segment Performance

Commercial Banking drove the bulk of earnings growth, benefiting most from Heartland's commercial loan portfolio. Personal Banking returned to profitability after losses in prior quarters.

Full Year 2025 Highlights

The modest decline in ROE reflects balance sheet dilution from the Heartland acquisition, which significantly expanded equity. Management expects profitability metrics to improve as integration synergies are realized.

Forward Catalysts & Risks

Potential Catalysts:

- Heartland market penetration: Management sees "significant penetration opportunity" in newly acquired markets

- Trust & securities processing: 12.8% YoY growth in institutional banking, driven by alternatives (PE, hedge funds) and corporate trust

- NIM tailwinds: SOFR basis risk favorable, bond reinvestment yields above roll-off

- Revenue synergies: Mortgage, credit card, treasury management cross-sell into Heartland customer base

- Off-balance sheet liquidity: $20B deposits held off-balance sheet can be brought on to fund growth

Key Risks:

- Economic slowdown: Could impact credit quality, though 20-year NCO average is just 27 bps

- CRE concentration: Investment CRE exposure requires monitoring

- $100B threshold: Management "wary" of deals that would push them close to this regulatory threshold

- Rate sensitivity: Neutral positioning means less upside if rates fall materially

20-Year Track Record

CEO Kemper closed the call highlighting UMB's long-term consistency :

"We live at the intersection of industry-leading growth and industry-leading quality... You've got the same team telling you when we say something we're going to do, we do what we say, and we say what we do."

— Mariner Kemper

Analysis based on UMB Financial Corporation Q4 2025 earnings call (January 28, 2026) and 8-K filed January 27, 2026. Operating metrics are non-GAAP; see company filings for reconciliations.

View UMBF Company Profile | View Q4 2025 Transcript | View Prior Earnings